By: Connor Choe

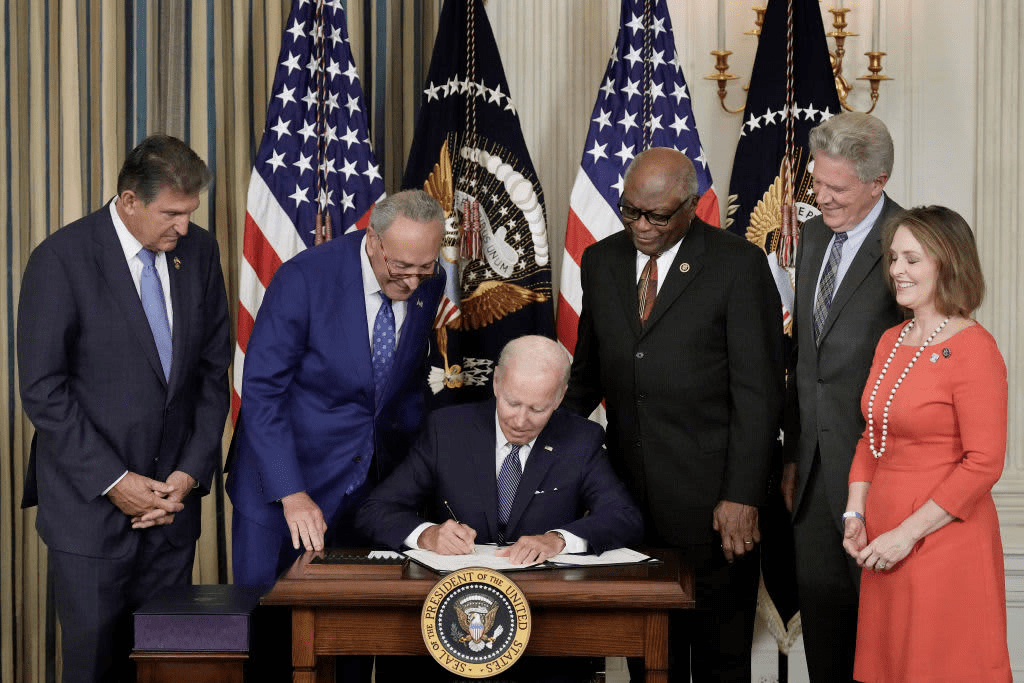

Joe Biden signed the Inflation Reduction Act (IRA) into law in 2022, allocating over $500 billion over the next decade to support clean energy development, healthcare affordability, and tax fairness. While inflation has decreased significantly since the IRA’s passage, many—including President Biden—have acknowledged that this reduction is not directly attributable to the act. The name of the IRA can be misleading, as its primary goals are to shift resources toward sustainable energy practices, reduce healthcare costs, and ensure a more equitable tax system. However, its impact – if uninterrupted- will propel the US to a green future and help fight the world’s climate crisis.

The IRA directs substantial investments into the U.S. clean energy sector, including solar, wind, and hydroelectric power. It provides tax credits to individuals and businesses to incentivize the transition to clean energy, aligning with a broader, bipartisan effort to bring manufacturing back to America. For decades, China has been the world’s manufacturing hub, but the IRA encourages domestic production of clean energy components. States such as Arizona, those in the Midwest, and Southern states like Georgia are capitalizing on these incentives to manufacture solar components domestically. This reshoring of manufacturing creates jobs and revitalizes local economies. Even companies like General Electric, historically known for outsourcing production, are now bringing jobs back to the U.S. In fact, they plan to build the largest onshore wind turbine facility in the country in Schenectady, New York.

Reducing dependence on foreign energy sources, such as Middle Eastern oil, has long been a strategic objective for the U.S. The Oil Crisis of the 1970s demonstrated the risks of over-reliance on unstable foreign sources, and ongoing military engagements in the Middle East have been costly and complex. The IRA aims to bolster U.S. energy independence by promoting renewable energy, thereby reducing the geopolitical risks associated with fossil fuel dependence.

Financially, the IRA is structured to be deficit-neutral over time, partly through new revenue measures, such as a 15% minimum corporate tax rate and enhanced IRS enforcement to close the tax gap.

However, the future of the IRA could be uncertain if political leadership shifts. A potential reelection of Donald Trump could threaten the act’s objectives, as initiatives like Project 2025 propose to repeal IRA tax credits, loosen environmental regulations, and promote new fossil fuel projects. Such changes could undermine efforts to transition to a cleaner energy future. UN Secretary-General António Guterres has highlighted the urgency of the climate crisis, citing examples like the Pacific Island of Tobago, which faces existential threats from rising sea levels. He warned that “this is a crazy situation” and emphasized the dire need for sustained, global action on climate change.

Sources

Leave a comment